Author:

FINNY team

Mar 3, 2025

Finding cash for your venture can be a bit overwhelming — especially when you're trying to decide between debt and equity financing.

To keep it simple: debt financing means borrowing money you'll need to pay back (think bank loans or credit lines), while equity financing involves selling parts of your business to investors who then share in your profits.

The global equity market hit $115.0 trillion in 2023 — that's a 13.4% jump from the year before. Meanwhile, the debt financing market reached $25.6 billion and is expected to grow to $73.3 billion by 2033. So both are viable options, but which one makes more sense for you? It really comes down to a few questions:

Do you want to keep complete control of your business? Or are you okay sharing decision-making power?

Can your cash flow handle regular loan payments? Because those payments don't care if you had a slow month.

With thousands of businesses changing hands every year, making the right financing choice could determine whether your great idea becomes a great success. So let's dig deeper into both options so you can make the choice that works for your unique situation.

What is Debt Financing?

Debt financing is how businesses borrow money to get things going. You get cash now, then pay it back later with a little extra. The great thing is that you don't have to give away pieces of your company in the process.

And we're talking about serious money here. According to the OECD, global corporate bond debt hit $34 trillion by the end of 2023. And even more interesting, over 60% of that growth since 2008 came from non-financial corporations.

Here's what makes debt financing what it is:

You've got to pay it back. Sounds obvious, but it's the big difference from equity — you're borrowing, not selling. And yes, there's usually interest involved.

It comes with a deadline. Most loans aren't open-ended — they have specific timelines for repayment.

Where can you find this money? There are several common places:

Bank loans are the classic option. You get a lump sum and pay it back in chunks over time.

Lines of credit give you more flexibility. You can dip in when you need cash, up to a certain limit, and just pay interest on what you actually use.

SBA loans might be worth looking into if you're running a smaller operation. They're backed by the Small Business Administration and often have better terms than standard bank loans.

Interest rates matter a lot in all this. Recent SIFMA data shows that U.S. long-term fixed income issuance actually dropped by 6.9% to $8.3 trillion in 2023, while equity financing jumped by nearly 40%. This shifting balance might affect the rates you're offered.

Your credit score will impact those rates too. Better credit usually means lower rates, so keeping your financial house in order pays off — literally.

And don't forget about taxes! Interest payments on business loans are typically tax-deductible. That can make a real difference in how much the loan actually costs you after everything's factored in.

Pros and Cons of Debt Financing

Let's talk about the good and not-so-good parts of debt financing. It's important to see both sides before jumping in.

Advantages

Probably the biggest plus: you don't give up any ownership of your business. You make all the decisions, set the direction, and keep all the profits (after paying back the loan, of course).

It might cost less than equity in the long run. Interest payments can add up, but they're often less than what you'd give up to equity investors over time. And with leverage improving in private equity deals — reaching about 4.1x average debt/EBITDA in 2024 (up from 4.0x in 2023) — it's clear that debt can be a powerful tool when used right.

Disadvantages

Nobody cares if you're having a slow month. Payments are due when they're due, regardless of your cash situation. That pressure can be tough, especially for newer businesses with unpredictable revenue.

It can squeeze your cash flow. Having to make regular payments means less money for day-to-day operations, growth opportunities, or handling unexpected expenses. You've got to be really good at managing your cash to make sure everything stays on track.

Making the choice between debt and equity isn't just about which one sounds better on paper. It's about what makes sense for your specific business, your growth plans, and how comfortable you are with different kinds of financial pressure.

What is Equity Financing?

Equity financing is very different from debt. Instead of borrowing money, you're actually selling pieces of your company. It's like having roommates in your business. You get their money now, and they get to own a part of what you're building.

While 65.8% of debt agreements have fixed terms, equity investments stick around indefinitely. That's something to think about when you're deciding which way to go.

Key Characteristics of Equity Financing

When you go the equity route, a few things happen:

Your ownership gets diluted. Each time you issue new shares, your slice of the pie gets a little smaller. This doesn't always feel great, but it might be worth it for the cash you need.

You're in a long-term relationship. These investors aren't just passing through — they're settling in. That means their goals need to line up with yours, at least somewhat.

No monthly payments! This is a big one. Unlike loans, you don't have to write checks every month. Your cash flow stays healthier, which can be a lifesaver for new businesses.

Sources of Equity Financing

So where does this money come from? A few different places:

Angel investors are often wealthy individuals who put their own money into early-stage companies. They're usually more patient than banks and might offer advice along with their cash. Some angels have been in your shoes before and know what you're going through.

Venture capital firms pool money from different investors to back startups with big growth potential. They typically want a bigger stake and might want some say in how you run things. The VC world has been going through some changes lately — fundraising dropped by 24% year over year, marking the third straight year of decline.

Going public. U.S. equity issuance hit $139.1B in 2023 — that's up 46.2% from the previous year. Most of this ($107.2B) came from secondary offerings, which means companies that were already publicly raising more money.

Pros and Cons of Equity Financing

Just like with debt, there is good and bad to equity financing.

Advantages

No regular repayments to worry about. This is probably the biggest immediate benefit. Your cash doesn't walk out the door every month to pay lenders, which means you can use it for growing your business instead.

You get more than just money. Good investors bring experience, connections, and sometimes even direct help. They've usually seen businesses like yours before and can help you avoid common mistakes. That's a value you don't usually get from a bank loan.

Disadvantages

When you take equity investment, you own less of your business.

You might lose some control over decisions. When other people own pieces of your company, they get some say in how it's run. Even if you keep majority ownership, investors often have rights that give them influence over big decisions. That can be frustrating if you're used to calling all the shots.

At the end of the day, choosing between equity and debt isn't just a financial decision — it's also about how you want to run your business. Some entrepreneurs would rather pay interest than answer to investors. Others prefer giving up some ownership to keep their monthly expenses lower.

Key Differences Between Debt and Equity Financing

When you're trying to fund your business, it helps to know what sets debt and equity financing apart. Let's look at a couple of the big differences.

Repayment Obligations

With debt financing, you've got to make those regular payments, both the principal and the interest. For new businesses or ones growing fast, this can be a bit of a squeeze on your cash flow.

Equity financing works differently. There aren't any mandatory repayments. Your investors make money through dividends when you're profitable or when the business value goes up. This gives you more wiggle room with your day-to-day finances.

Ownership Structure Implications

Debt financing keeps your business as yours. You stay in control and can keep steering things according to your vision without someone else weighing in.

Equity financing means giving up some ownership. You're selling pieces of your company, so your control gets diluted. Decisions might need everyone's agreement, which can make things more complicated.

Evaluating Financing Options for Business Growth

When you're figuring out how to fund your growth, there are several things to think about. Here's what might tip the scales one way or the other:

1. Economic Climate

The state of the economy can really impact your choices. When the economy's doing great, equity financing often looks better because investors are more willing to take risks. This might be a good time to consider early exercise of stock options. But during downturns, debt financing with lower interest rates could be more attractive.

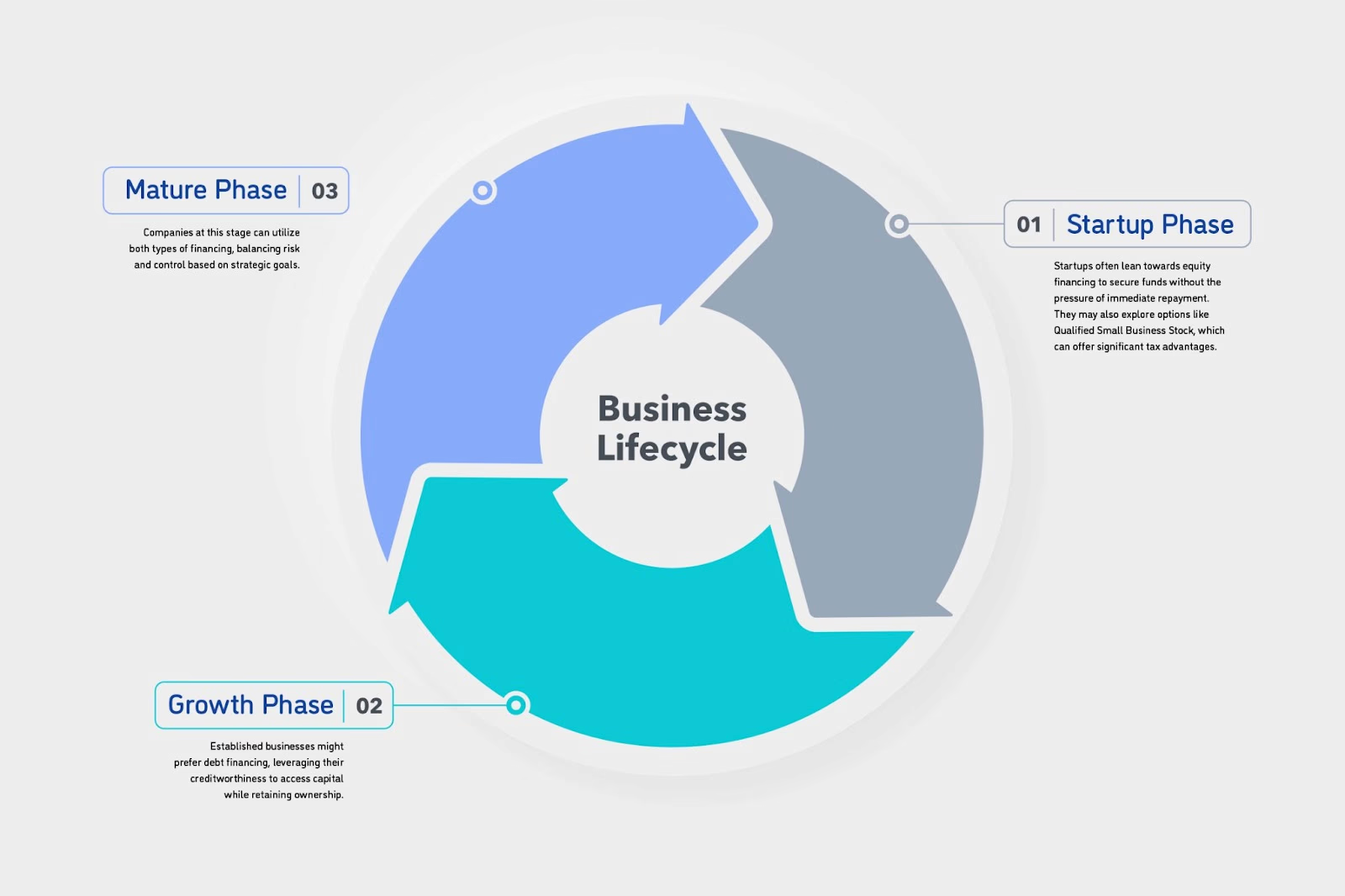

2. Business Lifecycle Stage

Where your business is in its life matters a lot too:

If you're just starting out, equity financing usually makes more sense. You get the money without having to make payments right away when your cash flow might be unpredictable.

If you're in a growth phase and have been around for a while, debt financing might work better. You can use your good credit to get capital while keeping ownership of your company.

For mature businesses, you can probably use both types, finding the right mix based on what you're trying to achieve.

These differences can have a real impact on how your business runs day-to-day and what you can do long-term. Understanding them helps you make smarter choices about funding.

Risk Assessment in Financing Types

Risks are a big part of any financing decision. How comfortable you are with different kinds of risk can really shape whether debt or equity makes more sense for your situation.

Debt Financing Risks

Those regular payments can put pressure on your cash flow. This gets especially tough during economic downturns or when business is slow. It's one thing to make payments when money is flowing in, but it can be pretty stressful when things tighten up.

Defaulting on loans? That's where things get serious. You could face bankruptcy or lose valuable assets that you put up as collateral. Not a great position to be in.

Equity Financing Risks

When you share ownership, you also share control. Your business decisions might need to include other voices now, which could change your strategic direction. Some entrepreneurs find this really difficult after being used to calling all the shots.

Investors usually want growth and returns — and they might expect it faster than you're comfortable with. This pressure can limit how flexible you are with operations and long-term planning.

Figuring out which risks you can live with means taking a good look at your personal and business finances. You've got to weigh what you're comfortable with against what you need for growth. Each option comes with its own challenges, so thinking through the risks carefully is a must.

Making the Right Financing Choice for Your Business

Choosing between debt and equity financing is about your vision for your business, your comfort with risk, and your long-term goals.

Debt might be right if you want to keep full ownership and have stable cash flow to handle those regular payments. Equity could be your better option if you're looking for capital without repayment pressure and don't mind sharing some control in exchange for potentially valuable expertise.

Many successful entrepreneurs end up using both types at different stages. They might start with equity when risk is high and cash flow is unpredictable, then shift toward debt as their business stabilizes.

Making this decision can be complex, and that's where expert guidance comes in. Ready to make a more informed financing decision? Get matched with a financial advisor who understands the unique challenges entrepreneurs face.

Related posts

Get early access to finny, YOUR

ai-native prospecting AGENT.

Join Waitlist